If you’re a real estate investor looking for a rich and fertile area to make a profit, Texas is easily one of your best options. And before we get into the specifics of where you should invest in the Lone Star State, it’s crucial to discuss why it’s become such a hotspot for investors in the first place. There are myriad reasons, but we’ll start with talking about the more significant factors, which are listed below.

Thriving Economy

With money rolling in from oil, tech, agriculture, and energy, Texas boasts one of the most diverse economies in the nation. Just as well, this diversification has continued to expand as the state brings in technology and financial and health service companies to reinforce regional economies.

As a result of these efforts, the state’s economy is estimated to be worth $1.6 trillion and is still growing. This bustling economy and the job market continue to attract younger age groups to the area, creating a hotbed for investors to make their real estate dreams a reality.

Population Growth

Because of its bustling economy and affordable housing market, Texas’s population also continues to grow. And with a stable, diverse economy that offers a wide range of job opportunities for those who live there, Texas will continue to serve as one of the nation’s most popular relocation destinations. Inherently, there will always be a market for investing and selling homes for a profit.

Affordability

Of course, you can’t discuss reasons to seek real estate investment opportunities in Texas without discussing its overall housing affordability. As the real estate market began to recover, most major cities saw a substantial increase in home prices, so much so that it made homeownership impossible for many families. However, through all of that, Texas has remained an affordable place to live, with housing prices being more conservative when stacked against median household incomes.

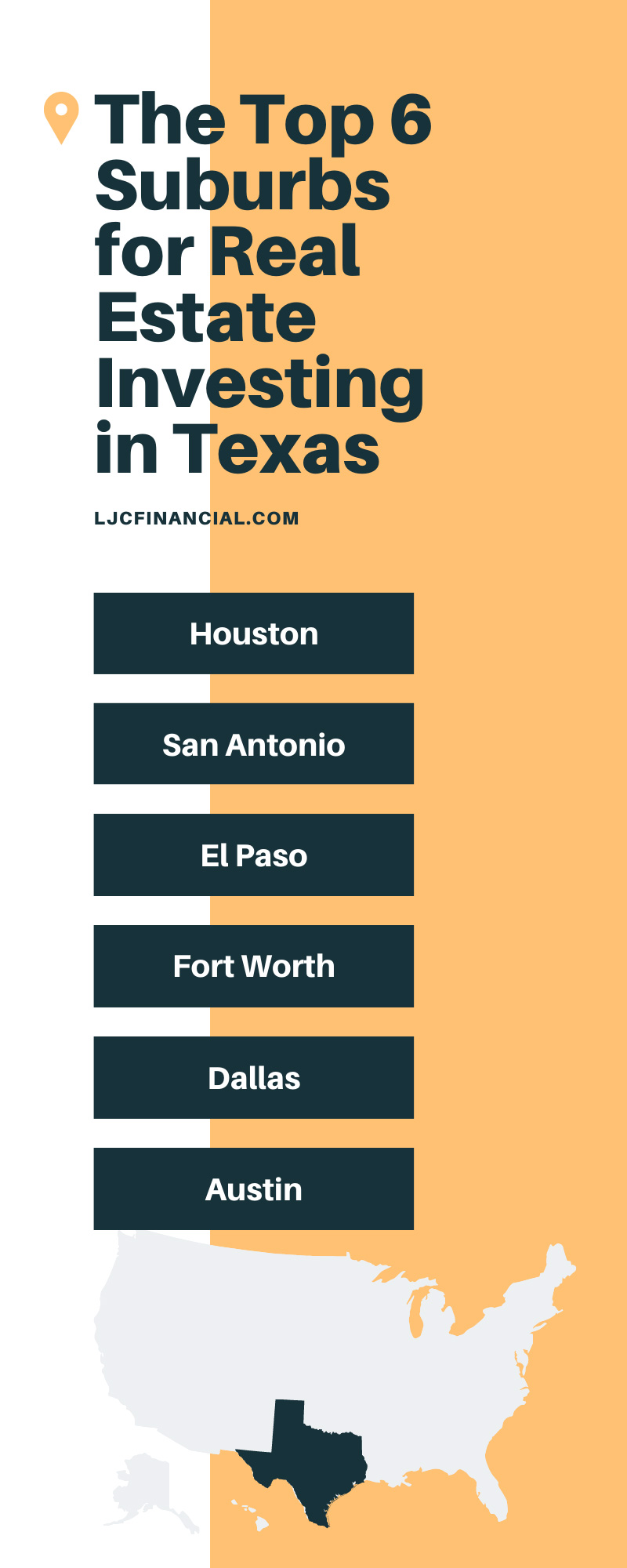

By now, you should understand why Texas is one of the best places for those seeking real estate investment opportunities. So, let’s take a moment to dive into specifics and look at the top six suburbs for real estate investing in Texas.

Houston

Houston and its numerous suburbs are some of the top destinations for Texas transplants to buy homes. This is due to a diverse job market and an abundance of affordable housing. As you can imagine, these factors alone make it an appealing choice for investors looking to snag reasonably priced properties in the area.

Plus, Houston’s real estate market is more stable, with a median home price of $238,000 and an average monthly rent of $1,285. So, if you’re looking for an excellent location to garner some investment properties, you’re almost guaranteed to find something affordable and in high demand in Houston.

San Antonio

San Antonio is home to booming suburbs, with populations expected to grow by at least 3.3 percent over the next two years. The city itself is the second largest in the state, and employment rates continue to increase by an estimated 2.2 percent year-over-year. Moreover, home prices are expected to jump by 8 percent, with rent yields on track to improve by 6.4 percent.

On top of that, San Antonio is also named one of the best places to invest in condo properties nationwide. So, when you consider how much potential profit there is to be made from the city’s housing market, it’s easy to see why it’s made our list of top six suburbs for real estate investing in Texas.

El Paso

This small West Texas town is one of the state’s well-hidden gems for investment opportunities. To start, the median home price is $143,000, which falls below the state and national averages. In turn, this means that purchasing properties and turning them for a profit will likely be much more affordable than in other regions across the state.

It’s worth noting, too, that home prices in El Paso have not appreciated as much as other cities, such as Austin or Dallas, over the years. So, it’s not unrealistic to think that a clever real estate investor will find ample opportunities to buy properties and garner wealth through built-in equity.

Fort Worth

The North Texas city of Fort Worth is the fifth-largest metropolitan area statewide and the fifteenth largest in the nation. It’s currently home to some of the world’s largest organizations and has been listed as one of the best places for business and career growth, which indicates a healthy and stable job market. Further, the median price for homes in the area is around $306,902, a number that’s continuing to rise by 4.6 percent.

So, without a doubt, Fort Worth’s market can reward investors with some significant returns if they put their money in the right places. And, because price appreciation in this West Texas city is starting to slow down, opportunities for real estate investors will only continue to increase.

Dallas

Dallas is known as the corporate hub of Texas. And as it continues to redefine itself with development projects that bring people back to the downtown area, it’s never been a more attractive and youthful place to call home. This metropolis and its surrounding suburbs have a steeper median home price of $450,000, and this average continues to rise by 10 percent.

Moreover, the Dallas housing market is one of the most competitive, with generally stagnant home inventory numbers. When you pair that with a solid economic base, steady job growth, and a lifestyle that appeals to the millennial demographic, it’s easy to see how the long-term development of real estate investment opportunities is inevitable.

Austin

Austin has recently garnered high acclaim as one of the most desirable real estate markets in the country. And with its rapidly growing technology sector and low housing prices, it isn’t hard to see why. The area has also seen an increasing demand for housing, which is always a crucial component to creating a fertile market for real estate investment.

With an influx of people relocating to Austin, there’s also been a steady increase in population. This means higher demand for affordable housing, which is excellent news for those looking to invest in and sell properties.

We hope this comprehensive guide provides some new and exciting information about the investment opportunities in the Lone Star State. And remember, if you need help financing your investments, you can always call LJC Financial. We can set you up with various financial backers, such as bridge loan lenders, that’ll help you make the most out of your investments.